An unexpected event, but with a dramatic impact on the world. Sometimes it flies in and out, but it leaves a mess. The black swan is back.

It wasn´t different in 2008, when it hit the global financial system hard. Or in 2011, when Europe was shaken by the debt crisis. The world has not recovered yet from these consequences of crises a decade ago, as evidenced by zero interest rates and continued quantitative releasing. While the consequences of the previous system destruction still persist, the black swan flew over the world again. This time with even greater potential consequences.

Countries are fighting the crisis

Epidemiological or economic crises have at least one thing in common: they can be stopped. Many countries in Asia have shown how the spread of the malignant virus can be counteracted and almost completely eliminated. Managerially and state-wisely, this is a difficult struggle, but it is possible.

If rapid and effective action is taken and the spread of the virus is stopped in the first phase, as has been the case, for example, in Singapore, the economic consequences are minimal. However, if the infection becomes an epidemic, the steps are much more complicated and painful. South Korea has also shown that such a situation can be handled.

European failure

Europe has lagged far behind in preventing and preparing plans, testing potentially infected people, collecting and evaluating data. But also in the approach of individuals to the spread of the epidemic. Not surprisingly for many, the number of infections has risen by thousands per day in many European countries. And fears that they would exceed the level from China were confirmed.

The slump in economic output from the Wuhan area has shown how strong impact can quarantine have on the country’s economy. The downturn in the Chinese economy in the first quarter was the largest since the beginning of the measurement. This has also raised great concerns about the health of the European economy as the epidemic rises.

The situation in Europe is very different from situation in Asia. In the Asian value ladder on the top was family and the state was below it, in Europe it was the individual himself. It turns out that not only Europe’s unpreparedness for the epidemic, but especially Western individualism, is the greatest threat to the spread of the epidemic on the old continent.

In the United Kingdom, up to a quarter of the population has refused to change their coronavirus habits. Thats why also British government has not taken any more drastic measures, such as the abolition of mass events or the closure of schools.

The end of the current era of globalization?

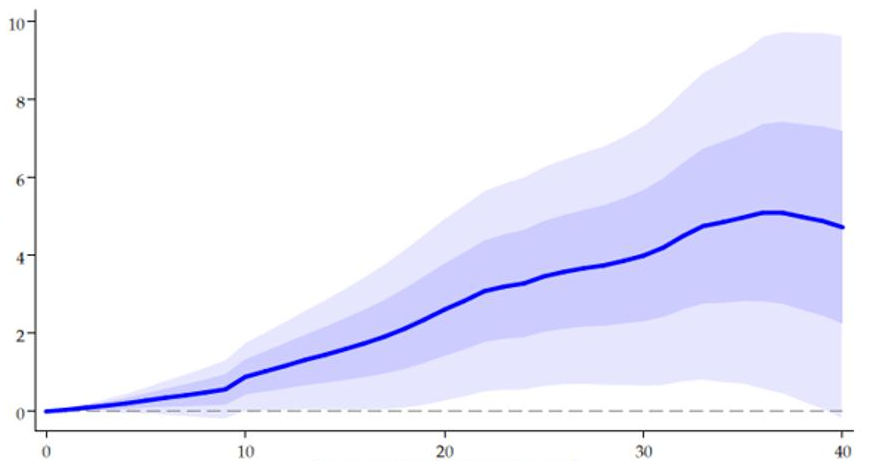

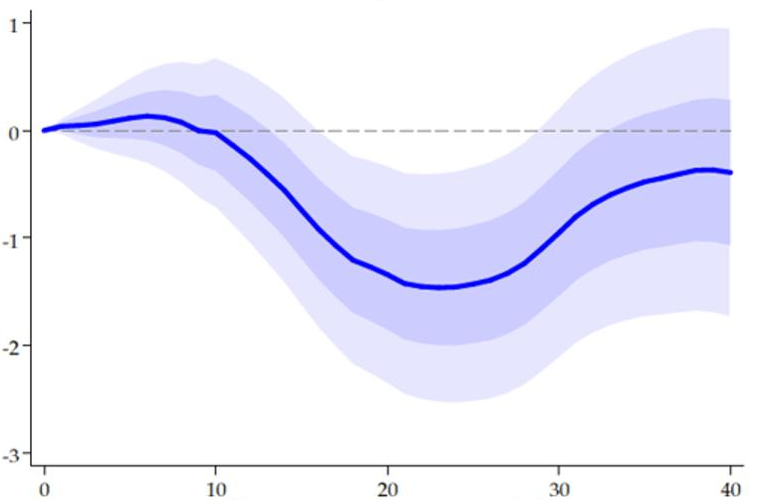

The coronavirus caused real rates to fall by 1.5% compared to the expected development without a pandemic. Many European pandemics have also resulted in declining trade. While stronger trade relations before the crisis brought a higher standard of living. Any concern for health has brought a slump. With the end of the Spanish flu came the end of the first era of industrial globalization, which had already subsided due to First World War. The corona crisis may block the supply chain from China, which has been built over the last two decades.

We can say that pandemics will push wages upwards, but they will disappoint in real returns. Unlike other disasters, such as wars or natural disasters, there is no big demand for capital after pandemics, which results in a longer period of real rates at a modest level.