Even at the end of last year, analysts believed that emerging market shares would benefit from the settlement of trade disputes and from China’s monetary policy impulses and would grow strongly. European actions, in turn, should benefit from better legibility of Brexit and the hopes of a “green” economic policy.

Coronavirus brings new cases in terms of economic activity

As usual, this pandemic affects its aggregate supply. It is therefore difficult to deal with its effects using standard macroeconomic instruments. The COVID-19 pandemic will cause a recession in the world economy this year, which could be worse than the financial crisis in 2008 and 2009. Financial markets are now counting on the likelihood that the virus will have economic repercussions beyond the first quarter of 2020. We will also see local outbreaks of infection similar to those in Italy and Spain and other countries, which temporarily disrupt economic relations. At the same time, negotiations on Brexit due to coronavirus will have to be postponed, which will also somewhat spoil the economy.

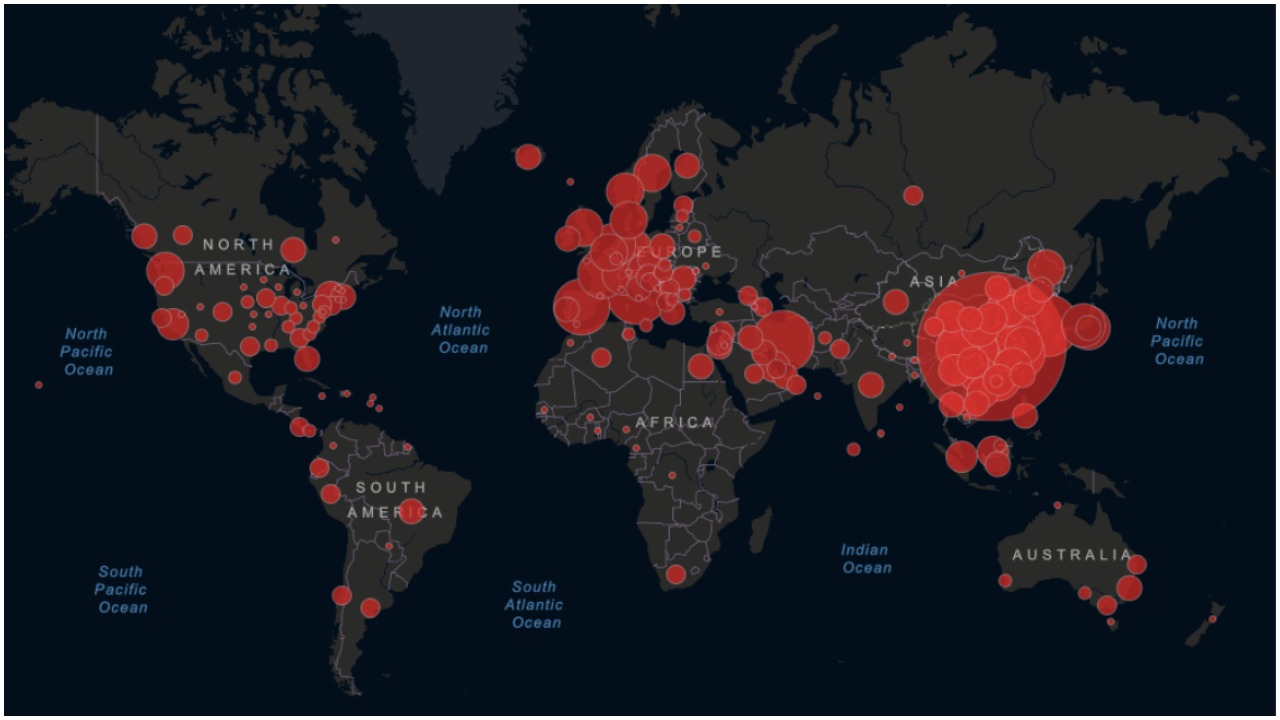

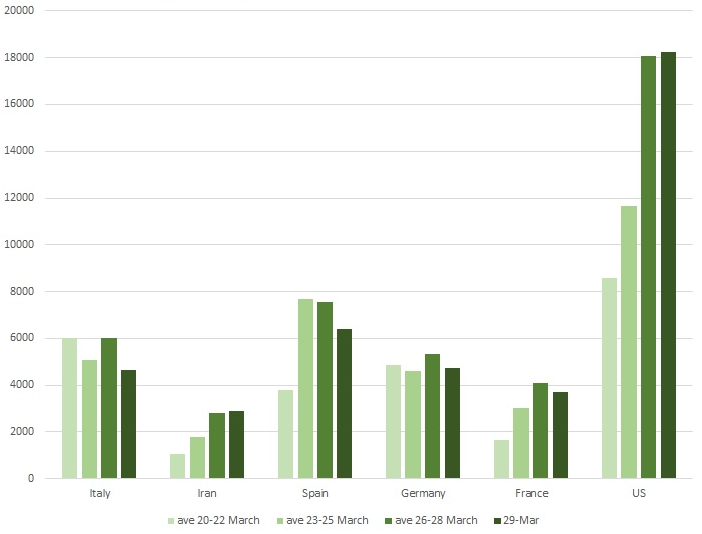

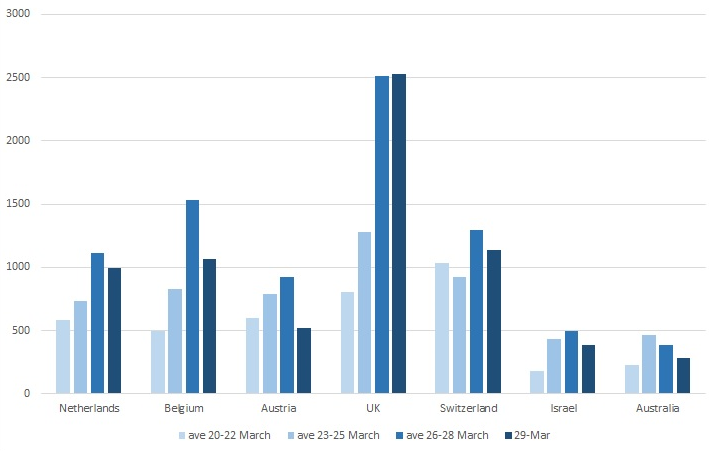

The virus first hit China, which in the world economy is equivalent to the countries of the Organization of Petroleum Exporting Countries (OPEC) in the manufacturing sector. Manufacturers around the world rely on components and parts manufactured in China. Although the epidemic seems to be depressing in this country, Chinese production has not yet returned to its original level. The virus also affected other Asian countries (Japan, Korea, Singapore) which are closely involved in global production chains. In recent days, the number of newly infected in the USA has increased significantly, and Germany and France have similar developments. So we are not just talking about China’s problem anymore. Italy and Spain and other European countries are at the forefront.

European central bank will help

The Organization for Economic Co-operation and Development (OECD) estimates that if the pandemic were limited to China and several other countries, world product growth would decline by around 0.5% this year. But if the pandemic spreads across the northern hemisphere, the impact could be as high as 1.5%, most of which will go to aggregate supply.

„The Governing Council shall, within the framework of its mandate, do whatever is necessary. If necessary, the purchasing program may be further increased. We are ready to ease some of the restrictions on bond purchases, which should help countries such as Italy, where these revenues have seen rapid growth as a result of the spread of the new virus.”

– European central bank

Of course, Rome has taken the most significant restrictions, where the numbers of victims of the disease have so far been greater every day than in the previous day. Schools, institutions, as well as all shops except food, pharmacies and selected drug stores are closed. Similar measures have been gradually introduced by other European countries. The same applies to the prohibition of traveling from the Schengen area to the United States of America. The mortality rate also suggests that Italy, Spain and the UK have far more cases than they were able to confirm and report.

Italy, Spain and the United Kingdom have a much higher mortality rate, which may be due to inadequate testing. At the same time, this may reflect a combination of congested healthcare systems and insufficient case reporting.

The role of fiscal policy will be to stimulate demand, as Hong Kong already does through direct financial injections. Monetary policy should, in turn, try to prevent financial conditions for firms from becoming more difficult. The late reaction of central banks may increase the risk of deflation, which is a very sensitive issue, especially in the developing world.