In an effort to reduce high unemployment, the state from 1 March 2017 introduced new rules of personal bankruptcy (change of Act no. 7/2005 about bankruptcy and restructuring). Its aim is to give a second chance to those who find themselves in a „debt trap“ and who are unable to get out of it themselves.

Financial literacy of people is improving, however many people still have to repay one loan with another. Problems appear when the amount of our installments exceeds one third of our income. However, the loss of employment or illness can be reason of our complicated situation. Personal bankruptcy is one of the ways how to get out of an unpleasant situation.

Is a downward tendency expected?

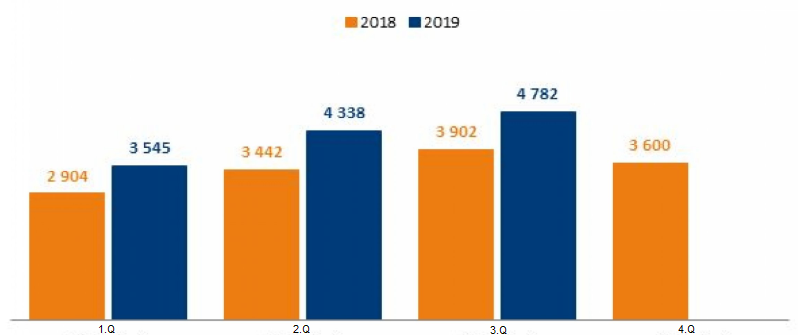

In 2018, the number of executions fell sharply compared to previous years. The main reason for the decline was legislative changes in personal bankruptcies. In the first quarter of this year, the number reached 3, 545 and in the third quarter up to 4,782. In year-on-year comparison, in the third quarter of 2019, more debtors went bankrupt by 22,55% than in the same period last year. Hovewer, compared to the last quarter of last year with 3,600 personal bankruptcies, this is 1,53 % less. A downward tendency can therefore be expected next year.

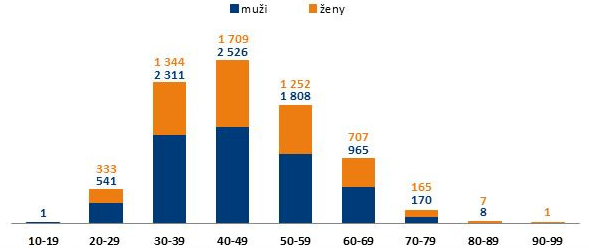

„In the first nine months of this year 12,665 personal bankruptcies were declared. In October 2019 their number has been higher than in the whole of last year, in which 13,848 personal bankruptcies were declared. In general, men´s bankruptcies are more often than women´s. Forty-year olds are the most represented in terms of age, but in March 2019 there were significantly more women than men in the age group of 70-year-olds.“

– Chief Analyst CRIF, Jana Marková

Before the former Minister of Justice Lucia Žitňanská came up with a new law about bankruptcy and restructuring, the possibility of personal bankruptcy was almost unreachable for ordinary people. Before the amendment came into effect, there were no real statistics to predict how interested it would be for people. At the present, any natural person can apply for debt relief without exception. Debt relief comes into effect when the decision of bankruptcy or repayment schedule becomes final at court.

It can be even easier

Any insolvent debtor who is a natural person, business person or non-business person, shall be entitled to seek the relief of his debts by bankruptcy or repayment schedules. S by the debt collection company There are no false promises, but you can rely on the promised result. The Borrower shall contact the relevant office by telephone or in person to obtain information about possibility of debt relief. He is contacted by phone within 24 hours and booked for a meeting at the nearest office of the Debt Relief Specialist.

The client is presented the whole process of debt relief. Specialist will book him for an assessment of his financial situation to see whether he meets all the requirements stipulated by law. After an assesment he is provided with report and proposal of solution within 7 days. After the client receive this report and proposal , the client is guaranteed and approved personal bankruptcy by the court. At the same time he/she receives a Personal Bankruptcy Application with all attachments. The signed application is sent to the Legal Aid Centre on behalf of the client. Throughout the entire debt relief process, the client is monitored until debt is fully released.

Also lawyers can have debts

If you think that only borrowers are financially illiterate you are wrong. Among others, clients are former succesful entrepreneurs, even lawyers, bankruptcy administrators or stockbrokers. Cases of secondary insolvency are also quite common. Self-employed are unable to repay their debts to insurance companies and have therefore taken out loans which they have failed to repay.

„The reason for personal bankruptcy is mainly high debt. Its very common that person misjudge the situation and one´s repayment posibilities or took too many loans in time of prosperity. Another reason is that borrower has no savings that he could use to repay debts in case of income loss. And last but not least reason can be loss of income caused by long-term unemployment or health problems that can lead to bankruptcy.“

– analyst from Postova banka, Jana Glasova

To stop an old execution may be possible if the debtor or creditor has disappeared without a legal successor and the execution was initiated before 1 April 2017. At the end of the old execution it is not decisive whether the creditor is a natural person, company or state. It may also be stopped by creditor´s proposal. There is oligation to pays only flat-rate costs of distrainer.

Whether the legislator´s intention to enable debtors to get rid of their debts and thereby motivate them to lead a proper life will only be seen in practice of the bankruptcy courts. We will see how they will approch individual proposals and also activity of debtors.